Not a Temporary Spike: Understanding DDR and eMMC Pricing in Embedded Systems

DDR and eMMC prices have remained a major concern for embedded system projects over the past year, especially in industrial applications.We have repeatedly received the same questions from CTOs, hardware engineers, project managers, and purchasing teams working on embedded systems:

- Why are DDR and eMMC prices still so high?

- Is this just a temporary fluctuation?

- Should we wait for prices to come down before moving forward with our project?

These questions are completely reasonable. DDR and eMMC prices have become one of the most sensitive variables in the BOM of Android and Linux-based embedded projects.

However, the reality is that the current DDR and eMMC pricing situation is not a short-term spike. It reflects a structural change in the global memory supply chain, especially for industrial and embedded applications.

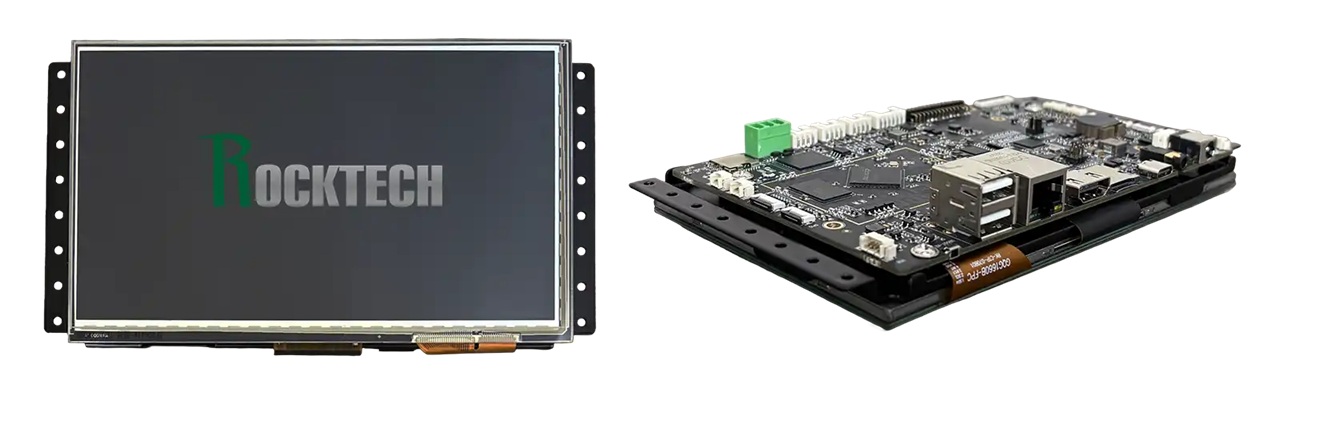

This article explains what is happening, why it matters, and how embedded projects can respond more effectively. And it focuses on Android & Linux SBC, industrial HMI, handheld devices, gateways, and edge systems.

What Has Changed in the Embedded Memory Market?

DDR and eMMC Cost Trends in Embedded Projects

In recent years, DDR (DDR4 / LPDDR4) and eMMC prices used in embedded systems have shown sustained upward pressure. This is particularly evident in common industrial configurations such as:

- 2GB / 4GB / 8GB DDR

- 16GB / 32GB / 64GB eMMC

For many engineering teams, the most frustrating part is not just the price increase itself, but the volatility. The same hardware platform, with the same memory configuration, may show noticeably different BOM costs within a relatively short time frame.

This is not an isolated case or the result of individual suppliers adjusting prices arbitrarily. It is a market-wide phenomenon affecting Android SBCs, Linux SBCs, industrial HMI panels, handheld terminals, gateways, and edge devices.

Why Industrial-Grade Memory Is More Affected

Compared with consumer electronics, industrial and embedded systems place additional requirements on memory components, such as:

- Extended temperature range

- Long-term availability and lifecycle support

- Stable quality across long production cycles

These requirements significantly narrow the pool of suitable memory components. As a result, industrial projects are more exposed to supply constraints and cost fluctuations than high-volume consumer products.

Why This Is Not a Short-Term Price Spike

AI and the Structural Shift in Memory Production

One of the most important drivers behind today’s memory pricing is the rapid growth of AI-related applications.

High-performance AI systems rely heavily on advanced memory technologies such as HBM (High Bandwidth Memory) and high-end DRAM. From a manufacturing perspective, this matters because:

- Memory fabs operate with finite production capacity

- The same production resources can often be allocated to different memory products

- HBM and high-end DRAM deliver significantly higher margins

Under these conditions, manufacturers naturally prioritize products that maximize profitability. The key issue is not whether memory can be produced, but which types of memory are prioritized.

Embedded and industrial memory products, while essential, do not sit at the top of this priority list.

The Position of Embedded Systems in the Global Supply Chain

From a global perspective, embedded systems represent:

- Smaller volumes

- Longer decision cycles

- More fragmented demand

Unlike major consumer or cloud customers, embedded projects typically do not receive guaranteed allocation during periods of tight supply. This makes them more vulnerable to pricing pressure and availability fluctuations.

Understanding this position is essential for realistic project planning.

Channel Effects and Price Volatility

Another factor amplifying price instability is the behavior of the broader distribution and channel market:

- Limited availability increases reliance on spot sourcing

- Price differences between channels become more pronounced

- Short-term fluctuations are magnified

This explains why similar memory configurations may receive significantly different quotations from different suppliers at the same point in time.

Should You Wait for Memory Prices to Go Down?

The Hidden Cost of “Waiting”

Delaying a project in hopes of lower memory prices often carries hidden risks:

- Hardware decisions block BSP, OS, and application development

- Certification and validation timelines are pushed back

- Product launch windows may be missed

For many embedded systems, the overall system cost of delay can exceed the potential savings from marginal memory price reductions.

Why Price Corrections May Not Solve the Problem

Even if prices soften in certain periods, corrections are often:

- Temporary

- Limited to specific densities or suppliers

- Uneven across DDR and eMMC categories

This makes timing-based strategies inherently uncertain.

System Cost vs. Component Cost

In embedded design, memory is only one part of the overall system cost. Software development, integration effort, certification, and long-term maintenance typically outweigh the cost of individual components.

Focusing exclusively on memory pricing can distract from the broader objective: delivering a stable, supportable, and scalable product.

How Embedded Projects Can Respond More Effectively

Re-Evaluating Memory Configuration at the System Level

Rather than defaulting to the highest possible configuration, many projects benefit from:

- Aligning memory size with actual application needs

- Avoiding over-specification where it provides no real benefit

This requires close collaboration between hardware, software, and system architects.

Locking Memory Configuration Early

Once a suitable memory configuration is identified, it is often advantageous to lock:

- Specific memory types

- Capacity combinations

- Supply expectations

Early decisions reduce uncertainty and allow downstream development to proceed smoothly.

Planning in Phases for Volume Projects

For projects targeting volume production, phased planning is critical:

- Prototype and validation stages

- Pilot runs

- Mass production

Clear visibility into expected yearly volume enables more stable sourcing strategies and more predictable cost structures.

The Advantage of Customized SBC and HMI Projects

In customized Android or Linux SBC and industrial HMI projects, memory decisions are typically made together with the hardware supplier at an early stage.

This approach allows:

- Better alignment between hardware and software requirements

- More realistic cost planning

- Reduced risk during mass production

Customization is not only about form factor or interfaces—it also plays a key role in managing component risk.

Our Approach: Transparent, Long-Term, Engineering-Driven

We continuously monitor the global memory market and its impact on embedded systems.

- When memory costs rise, we communicate early and transparently

- When costs decline, pricing is adjusted accordingly

- We focus on long-term project stability rather than short-term margin

Our goal is to support embedded projects through engineering-driven decisions, realistic planning, and long-term cooperation.

Turning Uncertainty into Controlled Decisions

Rising DDR and eMMC prices are not an anomaly—they reflect a broader shift in the industry.

For teams building Android or Linux-based embedded systems, the key is not to wait for perfect conditions, but to design projects that can operate reliably within the current reality.

If you are planning an embedded project involving an Android SBC, Linux SBC, industrial HMI, handheld device, gateway, or edge system, we are happy to discuss memory configuration, cost planning, and customization strategies together.